CHASE BANK ENCOURAGES FREQUENTLY TRAVELING CUSTOMERS TO USE CHASE VISA CREDIT CARD FOR TRAVEL EXPENSES

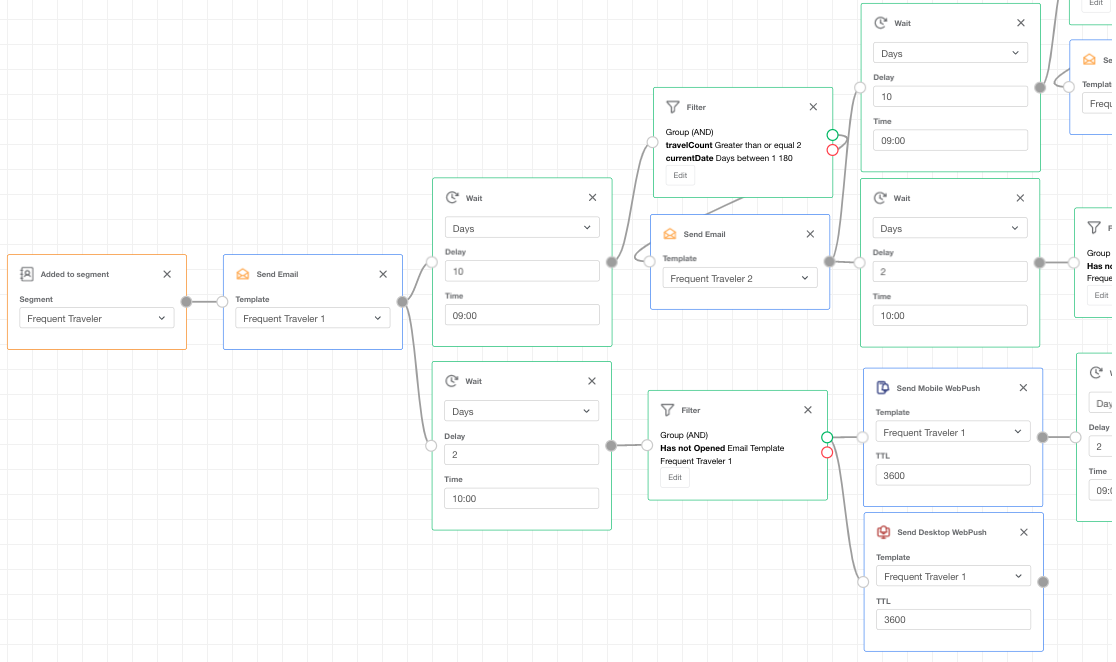

Preview the Workflow

Author:

Categories:

Tools:

Publication date:

Plan:

Description:

As a rule, customers are required to inform their bank or credit card company about when and where they are traveling to ensure their cards won't be frozen due to suspicious activity while they are traveling.

When your customers let you know that they are going away, you add a record to their account and share it with your fraud detection system. This prevents the “abnormal” spending patterns from triggering a block on the card.

This account information can also greatly help your marketing department to deliver more targeted messaging that will grow awareness and promote your rewards and benefits programs, such as earning travel points and bonus miles while using the card for travel expenses.

You can not only target travelers in general but also laser target your customers based on the frequency of their overstate and overseas travels.

This automation workflow shows how Chase Bank encourages its frequently traveling customers to use Chase Visa Credit Card for travel expenses and earn rewards and bonus points.

Implementation:

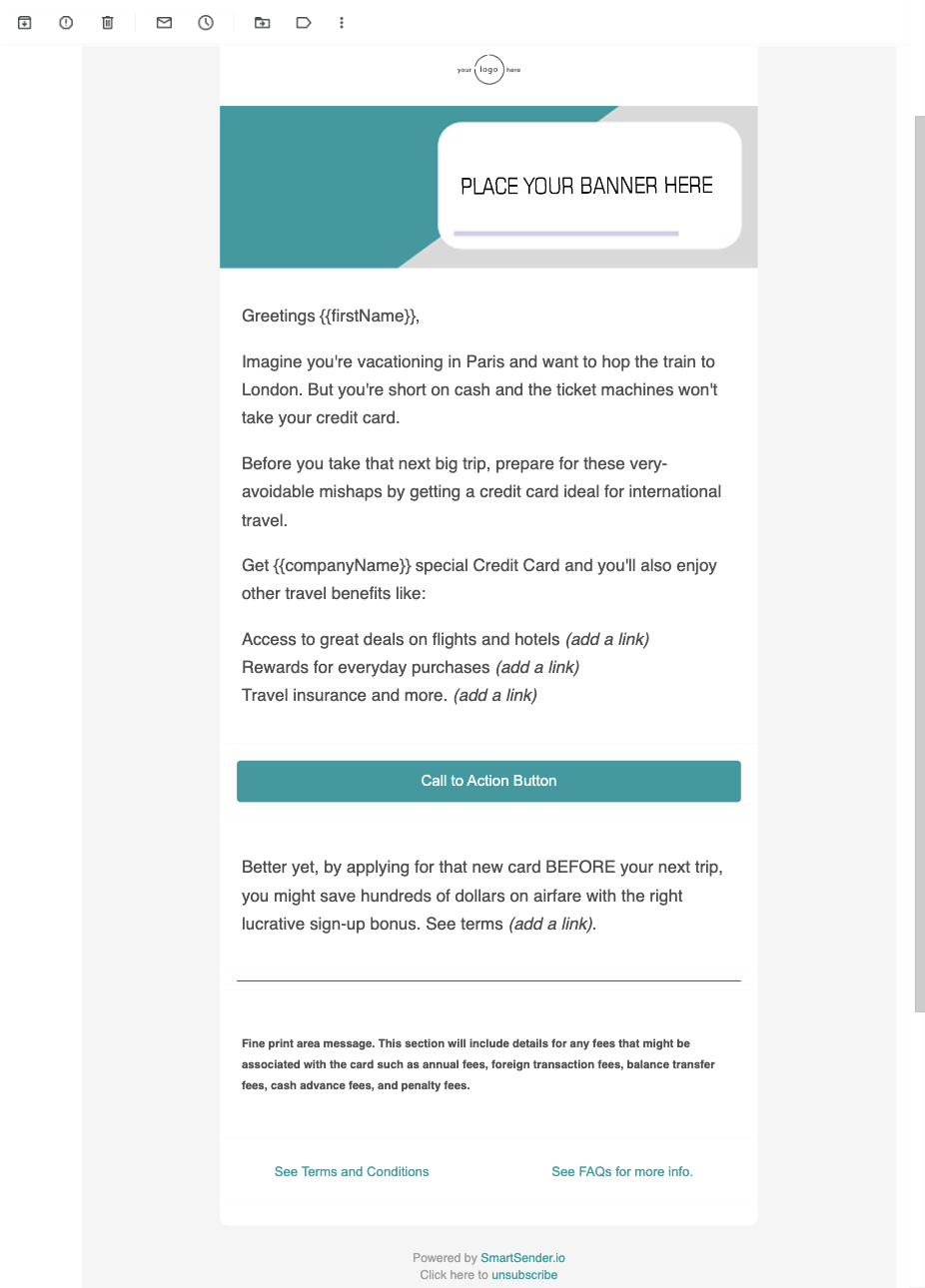

1. Once the new customer is added to the segment “Frequent Traveler,” the first email is sent to introduce the most important card benefits.

Then you wait for a couple of days to give the customer some time to open the email and read the content.

2. In two days, if the contact is still in the segment, the system checks whether the addressee opened your email, and if not, you’re welcome to send a desktop/mobile push notification. It is a shorter version of the first email directing the customer to the required landing page with the card benefit info.

In terms of personalization, it is always good to check whether the contact interacted with your previous message before pushing him/her further. In that case, you won’t overdo it with the same/similar content.

3. You can wait for another day or two, and if the contact is still in the segment and didn’t interact with the first email, then send an SMS, once again, to get in touch with the customer and encourage him/her to take the desired step/action.

This step is optional, but this is a perfect way to try to draw your customer’s attention through multiple channels and find out their preferred channel for further, more personalized communication.

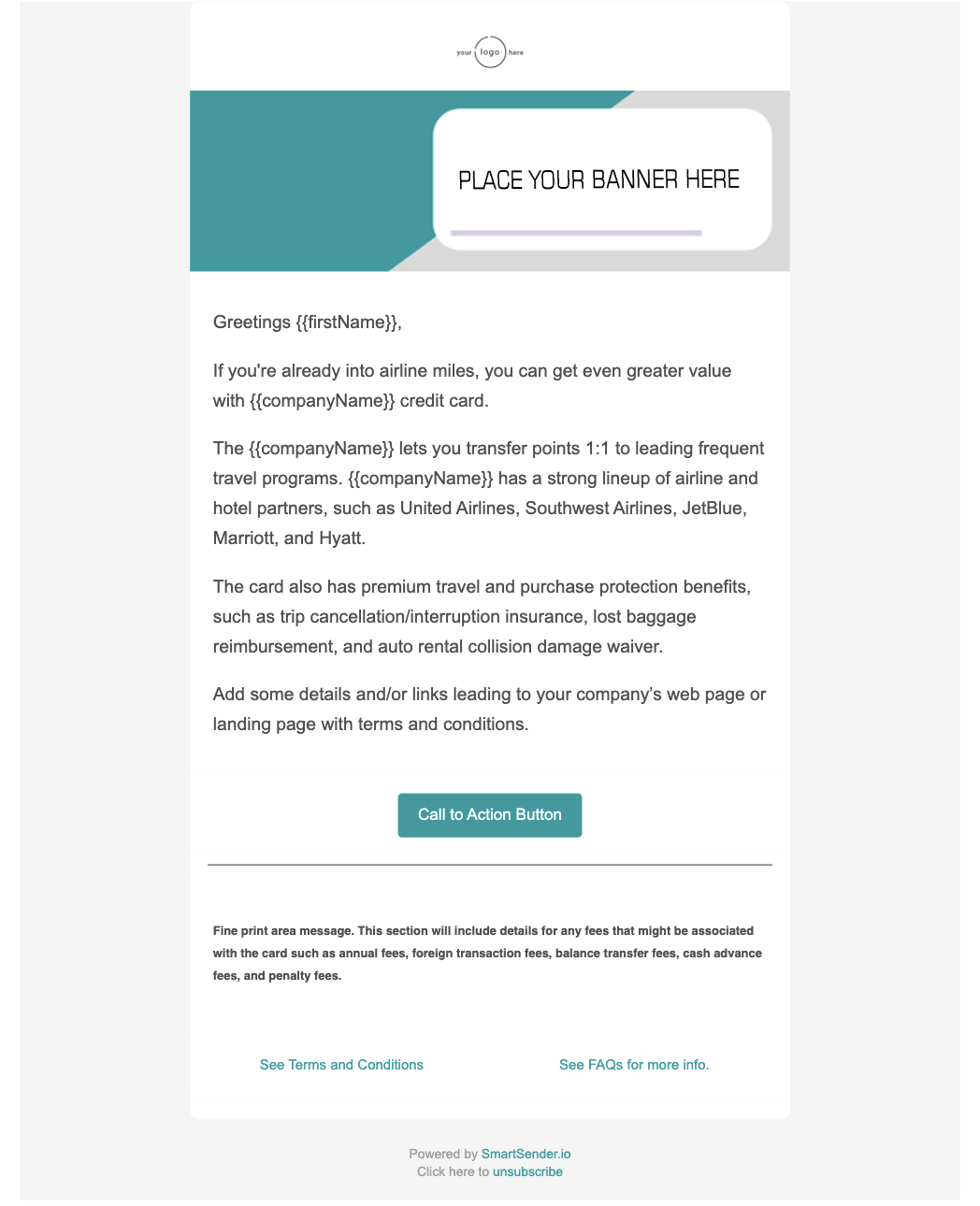

4. Wait for a week or so, and if the contact is still in the segment, send the second email with additional information regarding your rewards and bonus programs.

You can send as many emails as needed based on your email content plan. Remember to keep the same interval between the emails of the campaign because SPAM filters pay special attention to randomly sent emails.

5. Repeat steps 2 and 3 as many times as required.

6. If the customer takes your desired action, the contact is automatically dropped off the current segment and is added to another one with other campaigns of your choice, based on your marketing strategy (for example, regular newsletter recipient, inactive cardholder, etc.)